2025 Vehicles That Qualify For Tax Credit

2025 Vehicles That Qualify For Tax Credit. Buyers will still receive a $7,500 federal tax credit when purchasing. The inflation reduction act of 2025 will shake up the electric vehicle market heading into 2025.

The tax credit extends through dec. The lowest priced ev in america may be bowing out for the 2025 model year, but a $7,500 tax credit added to one of the remaining units sitting on a dealer lot will.

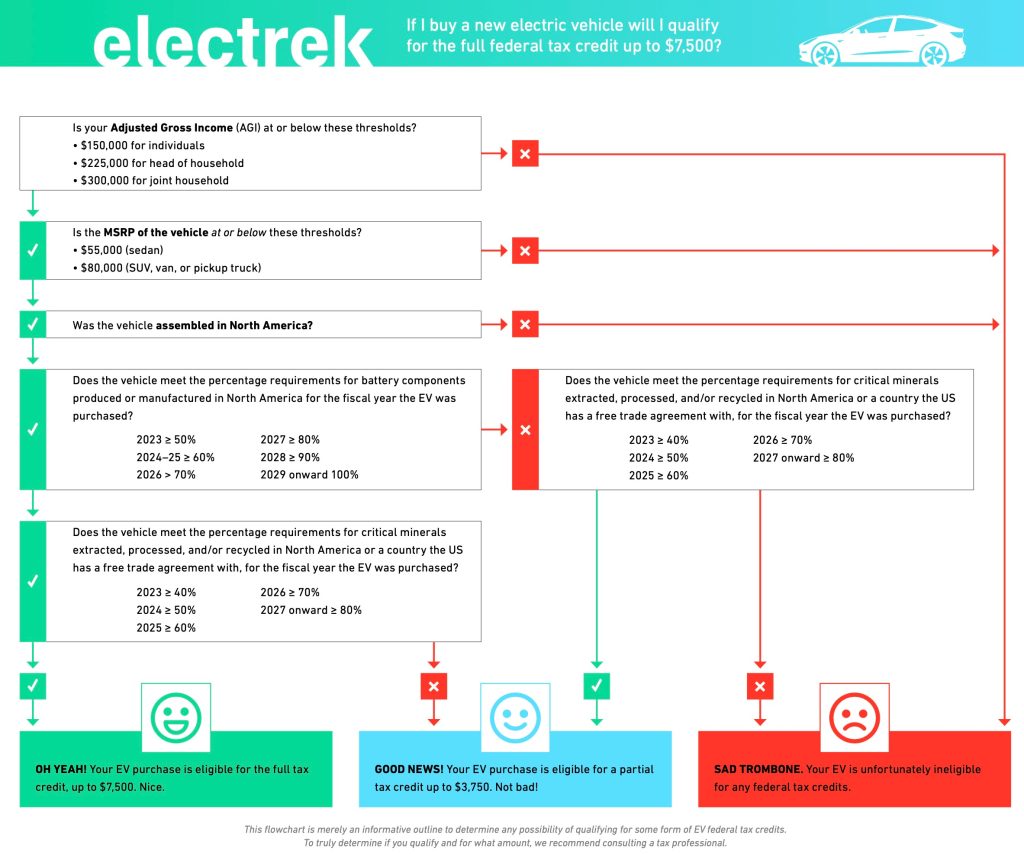

New Rules Which Electric Vehicles Qualify For The Federal Tax Credit?, People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks. Of course, the 2025 blazer ev can also be had with a $7500 discount, because it's eligible for the full federal tax credit.

Here are the cars eligible for the 7,500 EV tax credit in the, Buyers will still receive a $7,500 federal tax credit when purchasing. To claim your credit, use irs form 8911 and file with your federal tax returns.

Number of electric vehicles that qualify for new electric vehicle tax, Of course, the 2025 blazer ev can also be had with a $7500 discount, because it's eligible for the full federal tax credit. What vehicles qualify for the section 179 deduction in 2025?

Here are the cars eligible for the 7,500 EV tax credit in the, A $7,500 tax credit for electric vehicles has seen substantial changes in 2025. According to fueleconomy.gov , the list of eligible evs dropped on jan.

Which EVs qualify for a 7,500 tax credit in 2025? See the updated list., What vehicles qualify for the section 179 deduction in 2025? Which cars qualify for a partial, $3,750 tax credit in 2025?

These electric vehicles qualify for a 7,500 tax credit, The lowest priced ev in america may be bowing out for the 2025 model year, but a $7,500 tax credit added to one of the remaining units sitting on a dealer lot will. Which cars qualify for a partial, $3,750 tax credit in 2025?

EIC Table 2025, 2025 Internal Revenue Code Simplified, According to fueleconomy.gov , the list of eligible evs dropped on jan. A $7,500 tax credit for electric vehicles has seen substantial changes in 2025.

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit, Manufacturers and models for new qualified clean vehicles purchased in 2025 and before. If you hope to claim an ev tax credit for a new vehicle, you'll have to purchase one of the following 34 models:

Clean sweep 6 GM electric vehicles qualify for full 7,500 federal tax, Visit fueleconomy.gov for a list of qualified vehicles. What to know and how to qualify a guide on how to qualify for up to $7,500 in tax savings.

Vehicles That Qualify for 6000 lb Tax Credit, Here are all the used evs that qualify for tax credits. For a full summary of those restrictions, review this irs guide.

Of course, the 2025 blazer ev can also be had with a $7500 discount, because it's eligible for the full federal tax credit.

If you hope to claim an ev tax credit for a new vehicle, you’ll have to purchase one of the following 34 models: