Beneficiary Ira Rules 2025

Beneficiary Ira Rules 2025. The changes begin with the inflation adjustments for various medicare. Update on rmds under the provisions of the secure act and secure act 2.0.

The rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated, but at least one aspect is straightforward:. When you inherit an ira or roth ira, many of the irs rules for required minimum distributions (rmds) still apply.

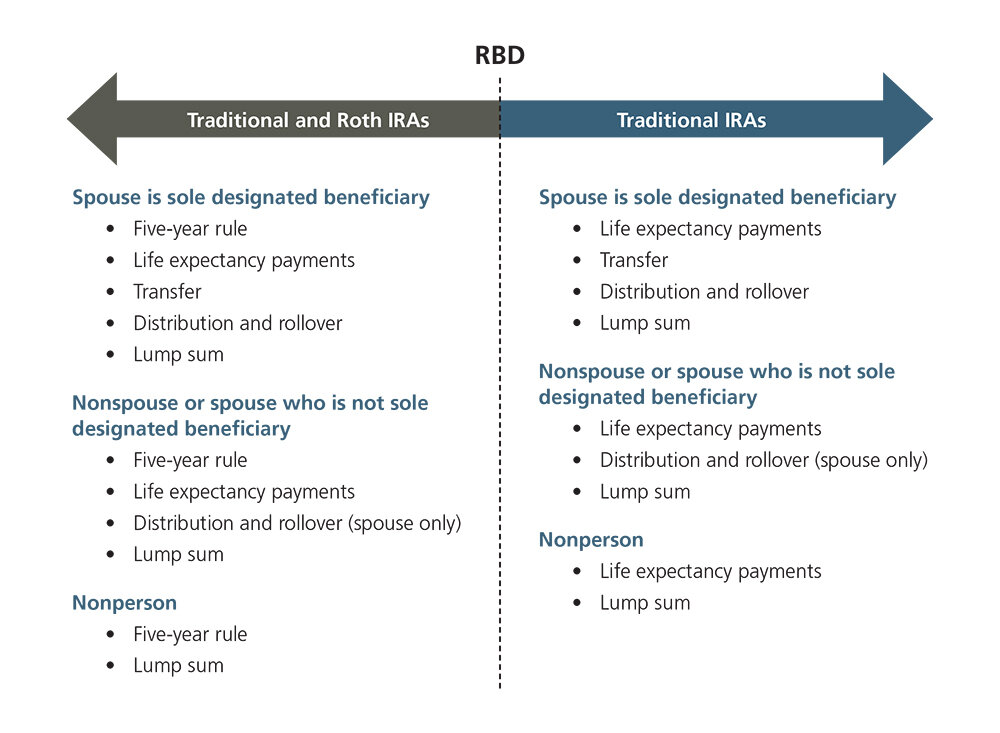

Beneficiary Ira Mandatory Distribution Table Elcho Table, You can't claim spousal benefits until your spouse has applied for benefits on. The secure act splits beneficiaries into one of three groups:

Successor Beneficiary RMDs After Inherited IRA Beneficiary Passes, Beneficiaries of retirement plan and ira accounts after the death of the account owner are subject to required minimum distribution (rmd) rules. All types of ira owners (traditional ira, sep, simple) must withdraw the minimum rmd, except for owners of roth iras.

IRA Beneficiary Rules Directly From the IRS TDECU, The internal revenue service has again. The 2025 secure 2.0 act brought welcome relief to retirement account owners by extending the beginning dates for required minimum distributions (rmds) from age 72 up to age.

Successor Beneficiary RMDs After Inherited IRA Beneficiary Passes, The irs defines an eligible beneficiary as: Roth iras only have a rmd.

Successor Beneficiary RMDs After Inherited IRA Beneficiary Passes, If you are the surviving spouse and sole beneficiary of your deceased spouse's ira, you can elect to be treated as the owner of the ira and not as the beneficiary. Here are projections for the 2025 irmaa brackets and surcharge amounts:

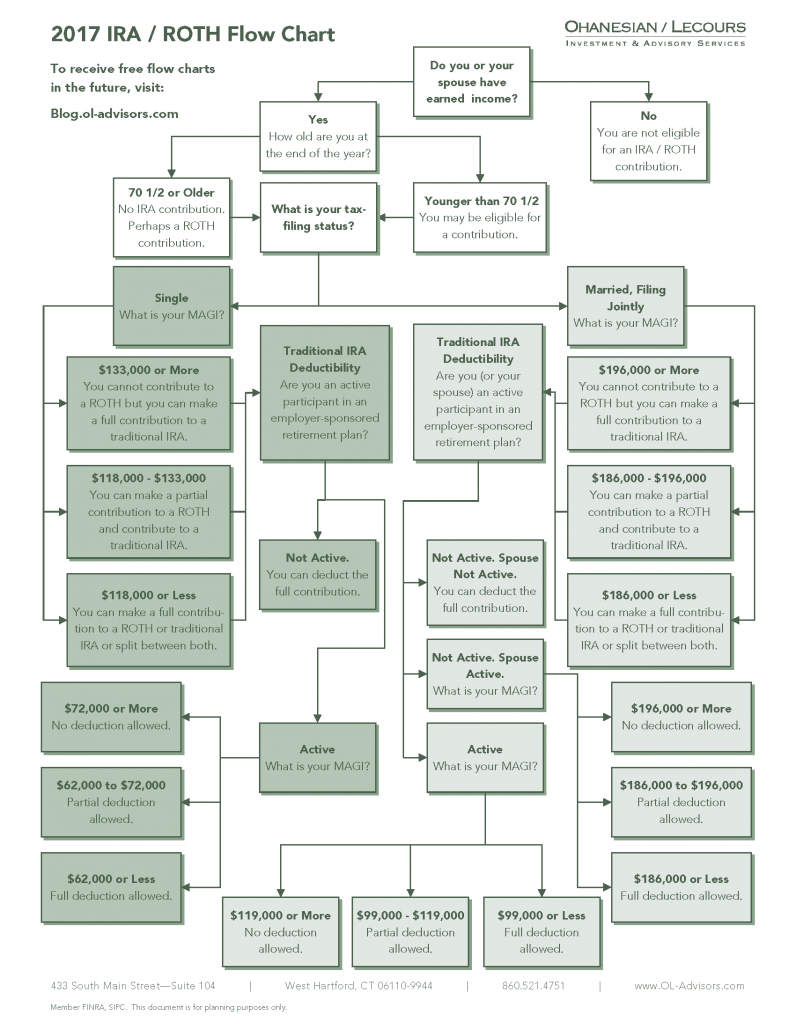

Visualizing IRA Rules Using Flowcharts, An ira beneficiary is an eligible designated beneficiary if the beneficiary is the owner's surviving spouse, the owner's minor child, a disabled individual, a chronically ill individual, or any other individual who is not more than 10 years younger than the ira owner. Irs delays inherited ira rules to 2025 what you need to know kiplinger, ira owners and employees with employer retirement plans must generally take rmds during their lifetime.

Spouse IRA Beneficiaries Handling New Restrictions for Inherited IRAs, If you are the surviving spouse and sole beneficiary of your deceased spouse's ira, you can elect to be treated as the owner of the ira and not as the beneficiary. The irs defines an eligible beneficiary as:

Inherited Ira Mandatory Distribution Table Elcho Table, An ira beneficiary is an eligible designated beneficiary if the beneficiary is the owner's surviving spouse, the owner's minor child, a disabled individual, a chronically ill individual, or any other individual who is not more than 10 years younger than the ira owner. Understanding the tax treatment of distributions and inherited ira rmd rules is crucial for ira beneficiaries.

+1000px.jpg)

Understanding Inherited IRA Rules for Beneficiaries, What does this latest rule delay mean? If you are the surviving spouse and sole beneficiary of your deceased spouse's ira, you can elect to be treated as the owner of the ira and not as the beneficiary.

What are the New Rules for Inherited IRAs? Inflation Protection, The rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated, but at least one aspect is straightforward:. Here are projections for the 2025 irmaa brackets and surcharge amounts: